ADVERTISEMENT

Retirement planning tips can set you on the path to a secure future. Having a solid plan in place ensures you enjoy your golden years worry-free. Learn how to effectively save and invest for your specific needs.

Many people underestimate the importance of early and consistent saving. By starting your retirement journey now, you can avoid pitfalls that lead to financial stress later.

ADVERTISEMENT

With the right information, your retirement can be a time of relaxation and joy. Keep reading to discover strategies that can help you achieve your retirement dreams.

Understanding Retirement Planning

Understanding retirement planning is crucial for anyone looking to build a secure future. It involves setting financial goals, knowing how much you need to save, and investing wisely. Many people start thinking about retirement too late, causing stress and uncertainty as the time draws near.

To effectively plan for retirement, begin by assessing your current financial situation. Calculate your expenses, income, and any debts. This will help you understand how much you need to save and invest to maintain your lifestyle after you stop working.

Retirement planning also includes choosing the right investment vehicles, like retirement accounts, to grow your savings over time. The earlier you start saving, the better off you’ll be. By taking action now, you pave the way for a comfortable retirement that lets you enjoy life to the fullest.

The Importance of Saving Early

The importance of saving early can’t be overstated. When you start saving for retirement in your 20s or 30s, even small amounts can grow significantly over time. This is because of something called compound interest, where your money earns interest, and then the interest itself earns more interest.

Saving early helps you build a financial cushion, bringing peace of mind as you approach retirement. The longer your money is invested, the more you benefit from the compounding effect. It allows you to take advantage of market growth and potentially have a larger nest egg to draw from in the future.

Additionally, starting early gives you more flexibility in your retirement choices. You can afford to make sensible investment decisions and take calculated risks. Without the pressure of catching up, you pave the way for a comfortable and enjoyable retirement.

Investment Strategies for Retirement

Investment strategies for retirement are essential to grow your savings effectively. A common approach is to diversify your investments. This means spreading your money across different types of assets, like stocks, bonds, and real estate. By doing so, you reduce the risk of losing money and increase your chances of gaining returns.

Another important strategy is to consider your risk tolerance. Younger investors can usually afford to take more risks because they have time to recover from market fluctuations. As you get closer to retirement, shifting to safer investments can protect your capital and ensure it lasts throughout your retirement years.

Additionally, regularly reviewing and adjusting your investment portfolio is crucial. As life changes, so do your financial goals. Keeping an eye on your investments helps you stay on track and make informed decisions that align with your retirement plans.

Types of Retirement Accounts

There are several types of retirement accounts that can help you save for the future. One common option is the 401(k), which is offered by employers. With a 401(k), you can contribute a portion of your salary before taxes. Many employers also offer matching contributions, which can boost your savings significantly.

Another popular choice is the Individual Retirement Account (IRA). This account allows individuals to save for retirement on a tax-advantaged basis. There are two main types of IRAs: Traditional and Roth. A Traditional IRA lets you deduct contributions from your taxable income, while a Roth IRA allows your money to grow tax-free.

Additionally, there are other accounts like the SEP IRA for self-employed persons and the SIMPLE IRA for small businesses. Each type of retirement account has its own benefits and rules. Understanding these options can guide you in choosing the right account that fits your retirement goals.

Creating a Retirement Budget

Creating a retirement budget is a vital step in ensuring you have enough money to live comfortably. Start by estimating your expected expenses during retirement. Consider costs like housing, healthcare, food, and leisure activities. Making a detailed list helps you see where your money will go each month.

Next, calculate your expected income sources. This may include Social Security benefits, pension payments, and withdrawals from your retirement accounts. Understanding how much income you will have allows you to see if it covers your expenses. If there’s a gap, you may need to adjust your spending or save more before retiring.

Lastly, review your budget regularly and make adjustments as needed. Life circumstances change, and so do expenses. Be flexible and willing to reassess your budget to maintain your desired lifestyle in retirement. Creating and sticking to a budget helps you feel secure about the future.

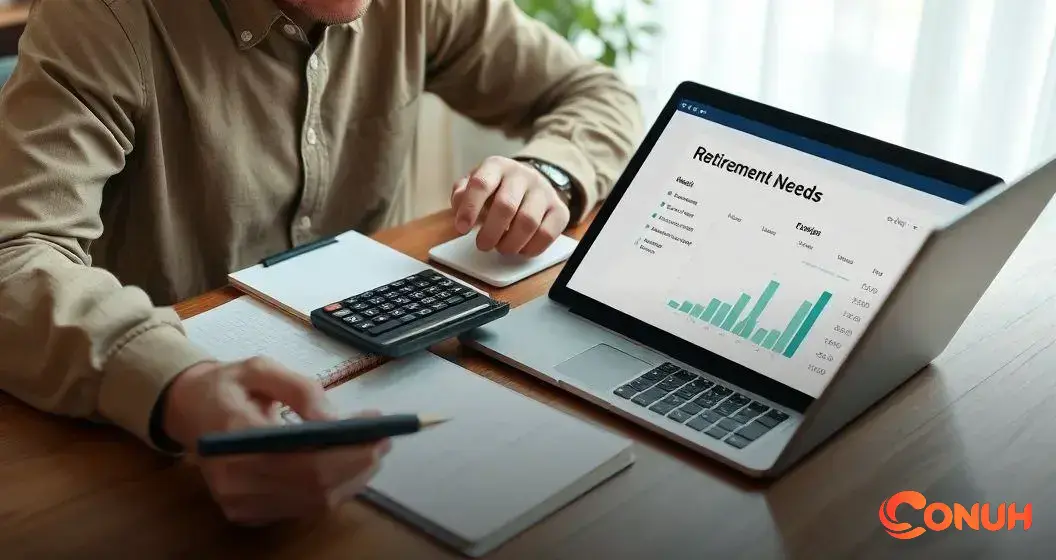

How to Calculate Retirement Needs

Calculating your retirement needs is an essential step in planning for your future. Start by estimating your annual expenses in retirement. This includes costs like housing, food, healthcare, and leisure activities. Be sure to consider both fixed and variable expenses to get an accurate picture of your financial needs.

Next, you’ll want to consider how long you expect to be in retirement. This can depend on your health, lifestyle, and family history. A common rule of thumb is to plan for at least 20-30 years in retirement. By calculating the total amount of money needed over this time, you can set realistic savings goals.

Finally, factor in any income sources you will have during retirement. This includes Social Security, pensions, or withdrawals from retirement accounts. By subtracting your expected income from your estimated expenses, you can determine how much you need to save to ensure a comfortable retirement.

Maximizing Social Security Benefits

Maximizing Social Security benefits is vital for your retirement plan. One important strategy is to delay claiming your benefits until you reach full retirement age or even later. Each year you wait to claim can increase your monthly benefit. This can result in a significantly larger sum over time.

Another way to boost your Social Security benefits is to ensure you earn enough credits before retirement. You earn credits based on your work history. The more you work and the higher your earnings, the larger your benefit can be. It’s essential to track your earnings and make sure the Social Security Administration has accurate records.

Also, consider your marital status when planning your Social Security strategy. If you are married, you may be eligible for spousal benefits, which can be higher than your own. Understanding these options and coordinating with your spouse can help you both maximize your benefits and enhance your financial security in retirement.

Common Retirement Planning Mistakes

One common retirement planning mistake is not starting to save early enough. Many people delay saving for retirement, thinking they have plenty of time. However, starting to save sooner allows your money to grow through compound interest, which can make a big difference in the long run.

Another mistake is underestimating retirement expenses. Some individuals think they can maintain their current lifestyle on a smaller budget. However, costs often rise in retirement due to healthcare, travel, and everyday living expenses. It’s important to create a realistic retirement budget to prepare for these costs.

Finally, failing to review and adjust your retirement plan regularly is a key mistake. Life changes, such as new jobs, family situations, or health issues, can affect your retirement needs. Regularly checking your investments and plans ensures that you stay on track to meet your goals and can help you avoid any surprises down the road.

Adjusting Plans As You Age

Adjusting plans as you age is an important part of retirement planning. As you get older, your financial needs and goals may change. It’s essential to regularly assess your retirement strategy to ensure it fits your current life situation. For instance, your health may require more medical expenses, which can affect how you budget.

As you approach retirement, you may want to shift your investment strategy. Younger investors can take more risks with stocks, while older adults may prefer stability and security. Moving toward safer investments, like bonds or cash reserves, can help protect your savings as you get closer to needing them.

Additionally, be open to reevaluating your retirement lifestyle. Travel plans, leisure activities, or even living arrangements may change as you age. By staying flexible and willing to adapt your plans, you ensure that your retirement remains enjoyable and secure, no matter how your circumstances evolve.